2024 Schedule B Form 1099 – You pay capital gains taxes with your income tax return, typically using Schedule D. The data from Form 1099-B helps you fill out Schedule D and Form 8949 if needed. If you owned an asset . A 1099-B is sent to a taxpayer listing the the “other income” line of a 1040 form, which is reported on line 8 of Schedule 1. There’s no perfect solution, but one thing is clear. .

2024 Schedule B Form 1099

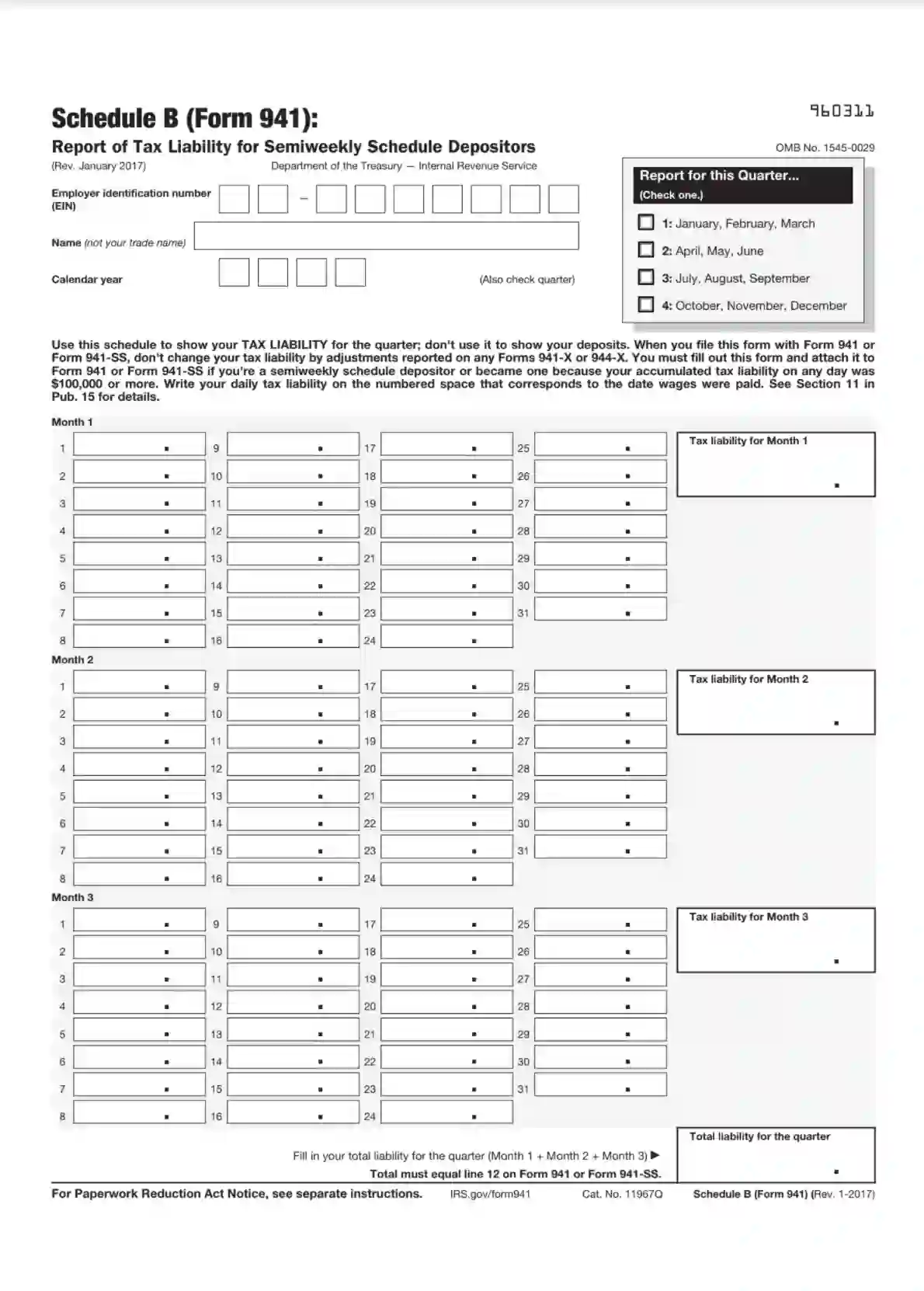

Source : form-941-schedule-b.pdffiller.comSemi Weekly Depositors and Filing Form 941 Schedule B | Blog

Source : blog.taxbandits.comSchedule b: Fill out & sign online | DocHub

Source : www.dochub.comIRS Schedule B Form 941 ≡ Fill Out Printable PDF Forms Online

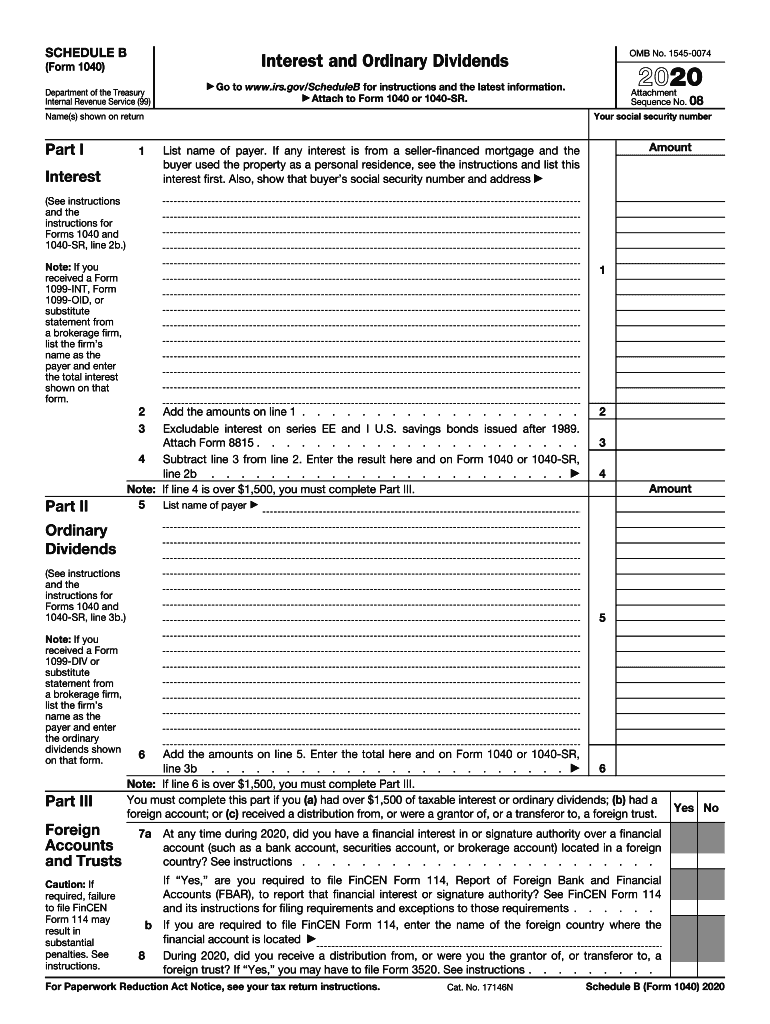

Source : formspal.com2023 Instructions for Schedule B

Source : www.irs.govB104 Form 1040 & 1040 A Schedule B Interest and Ordinary

Source : www.nelcosolutions.comForm 1040 For IRS 2024 | How To Fill Out Schedule A B C D

Source : nsfaslogin.co.zaBusiness tax deadlines 2024: Corporations and LLCs | Carta

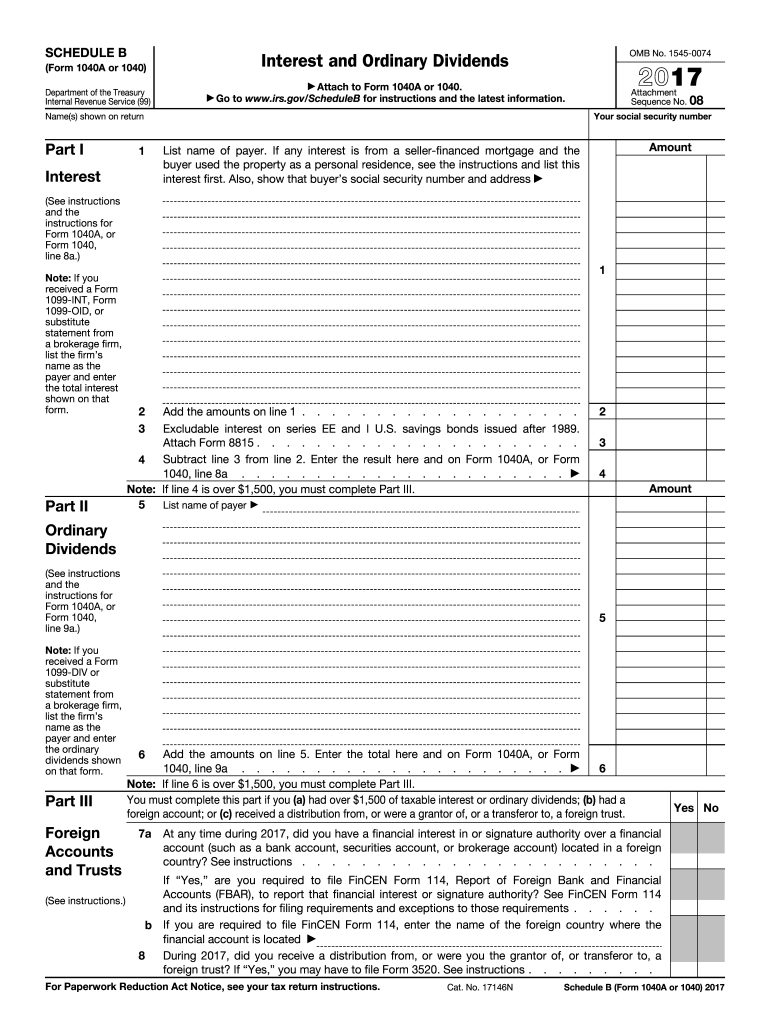

Source : carta.com2017 schedule b: Fill out & sign online | DocHub

Source : www.dochub.comIRS Form 1099 DIV Reporting on Form 1040 Tax Return YouTube

Source : www.youtube.com2024 Schedule B Form 1099 2017 2024 Form IRS 941 Schedule B Fill Online, Printable : There are many different versions of the Form 1099 depending you receive in 1099-B reporting capital gains from sales of stocks, mutual funds or ETFs on Schedule D, Capital Gains and Losses. . The new FAQs are in addition to the recently updated webpage, “Understanding Your Form 1099-K.” The revised FAQs include guidance on common situations, along with more clarity for the payment card .

]]>